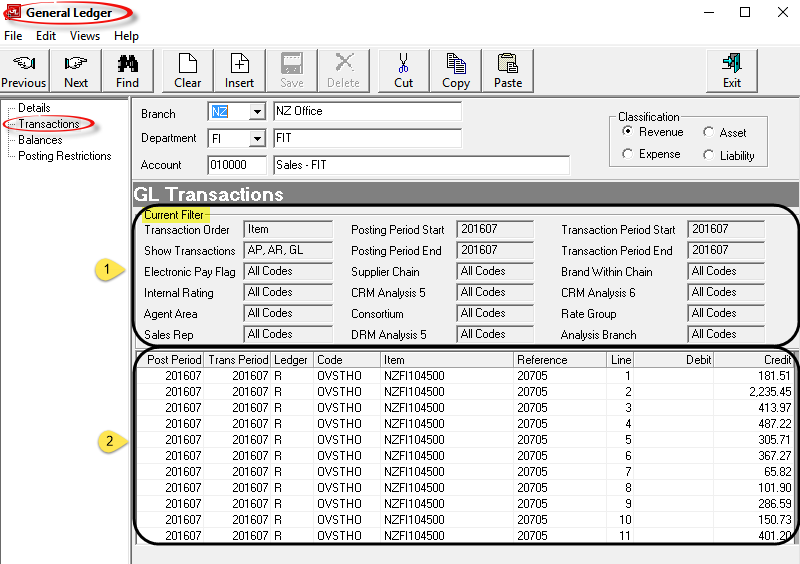

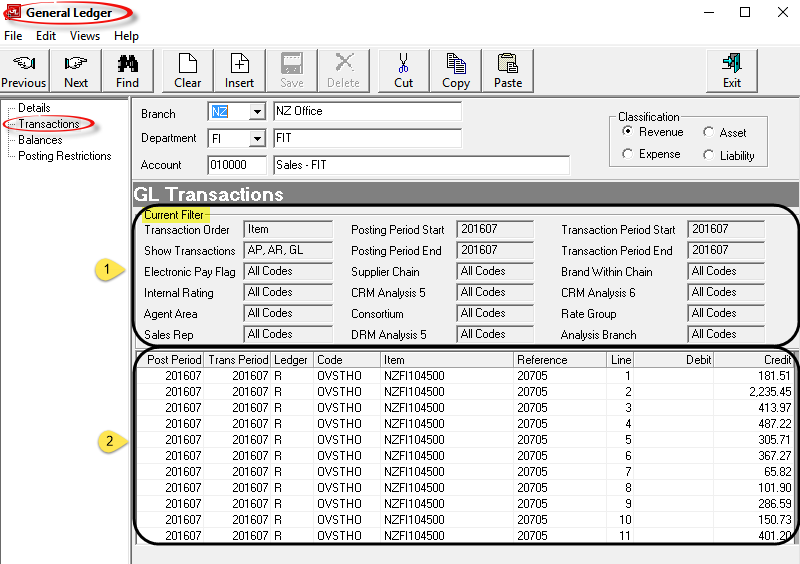

The Transactions node allows transactions posted to the account to be viewed. A filter screen is available allowing criteria to be used to select the transactions to be viewed.

Screen Shot 175: G.L. Transactions

Current Filter Panel

Current Filter Panel

This section of the screen shows the current filter selections. Descriptions of these fields are detailed below in the Transaction Filter section.

Transaction List

Transaction List

By default, all lines of individual transactions are displayed. Screen Shot 175 G.L. Transactions above is displaying lines 1–11 of debtor’s invoice 20705. A consolidated view is available. See Consolidate Transactions.

|

The column headings at the top of the scrolled rows are the only headings for this screen. |

Post Period

The posting period of the transaction.

Trans Period

The transaction period of the transaction based on the transaction date.

Ledger

The Ledger the transaction was posted from:

R–Receivables (Debtors)

P–Payables (Creditors)

G–General Ledger Journal

Code

The originating debtor or creditor code. This field is blank for G.L. Journal transactions.

Item

The transaction item code. For bookings related AR & AP transactions, the booking reference. For non-bookings related AR & AP transactions, the invoice number. For G.L. Journals, the journal reference.

Reference

The transaction reference—Invoice, Credit Note, Cheque, Receipt or G.L. Journal Reference.

|

For G.L. Journal References, this field excludes any manually entered Journal Reference Prefix or Suffix. |

Line

The line number of the transaction.

Debit

The debit value of the transaction, if any.

Credit

The credit value of the transaction, if any.

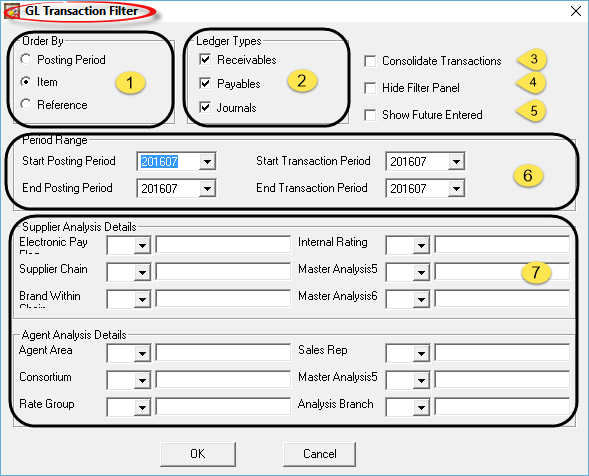

To open the Filter Transactions dialogue, click the Find button in the button bar.

Screen Shot 176: G.L. Transaction Filter Dialogue

Order By (radio button)

Order By (radio button)

This button controls the order in which transactions will be scrolled:

|

The display order can also be changed in the transaction scroll by double clicking on the column name that the transactions are to be sorted by. Double clicking the column a second time will reverse the sort orde of that column. |

Ledger Types (Checkboxes)

Ledger Types (Checkboxes)

Transactions can be selected from all ledgers or specific ledgers depending on the boxes checked.

Consolidate Transactions (Checkbox)

Consolidate Transactions (Checkbox)

Checking this box will consolidate all lines of a transaction into one line, and display debit and credit totals.

Hide Filter Panel (Checkbox)

Hide Filter Panel (Checkbox)

When checked, the Filter Panel in the centre of the transactions screen (Screen Shot 175 G.L. Transactions ) is hidden, leaving more room for the transaction display.

) is hidden, leaving more room for the transaction display.

Show Future Entered (Checkbox)

Show Future Entered (Checkbox)

When checked, any transactions posting to the account that have a transaction period that is in advance of the current G.L. Period will also display.

Period Range (Drop-downs)

Period Range (Drop-downs)

The drop-downs for Transaction Period From/To and Posting Period From/To, default to the current AR Period. These can be changed to search over a range of accounting periods.

Analysis Details (Drop-downs)

Analysis Details (Drop-downs)

Selection can be made based on specific Supplier or Agent analysis fields.

|

To continue, click the OK button |

|

To cancel, click the Cancel button |

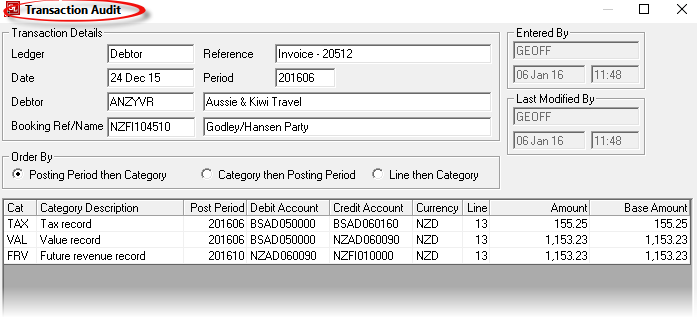

In the Transaction scroll, transaction lines can be double clicked to open a Transaction Audit window.

Screen Shot 177: G.L. Transaction Audit Window

|

The column headings at the top of the scrolled rows are the only headings for this screen. |

|

All fields in this window are display only. |

|

When transactions are displayed in Consolidated mode (see Consolidate Transactions), the audit window is not available. |

The G.L. Transaction Audit is slightly different to the Debtors and Creditors Transaction Audit. In debtors and creditors when the audit button is clicked on a transaction, the audit screen displays all lines in the transaction—e.g., if a debtors invoice with 10 lines in it is clicked, then all of the components for all 10 lines will display in the audit screen. In the G.L., the Audit Window displays only the line clicked on.

|

Heading |

Displays |

|

Ledger |

will display Debtor for a Debtors transaction, Creditor, for a Creditors transaction and Journal for a G.L. transaction |

|

Reference |

Transaction type and reference number. |

|

Date |

Transaction date. |

|

Period |

Transaction Period (TRP). |

|

Entered By/Last Modified By |

The user name and time of transaction creation and last modification |

|

Debtor |

The Debtor/Agent or Creditor/Supplier code and name. |

|

Blank fields x 3 |

Any User Defined text which may be attached to the Cheque Type. |

|

Booking Ref/Name |

(Invoice/Credit Audit Only) The booking reference and name that the Invoice/Credit Note applies to |

|

Bank/Branch/Account |

(Receipt Audit Only) These are the Receipt Type user text ( see Screen Shot 51 Receipt Type User Text Labels |

|

Receipt Type |

(Receipt Audit Only) The receipt type used on the receipt. |

|

Order By |

These radio buttons can be used to change the order of the display. |

|

Cat |

The Line Category. |

|

Category Description |

The extended category description. For receipts, tax is never posted to a tax account — that posting is part of the invoice transaction. However, because there is a tax line in the invoice, there has to be a corresponding line in the receipt. Note that the posting accounts for both the TAX and the VAL lines in Screen Shot 80 Receipt Transaction Audit Display are the same, meaning that the total of the VAL and TAX records will be posted to those accounts. |

|

Post Period |

The G.L. posting period (GLP). |

|

Debit Account |

The. G.L. Account to be debited with the line amount. |

|

Credit Account |

The G.L. Account to be credited with the line amount |

|

Currency |

The Currency of the transaction |

|

Line |

The transaction Line Number |

|

Amount |

The line amount in transaction currency. |

|

Base Amount |

The amount in system base currency. |

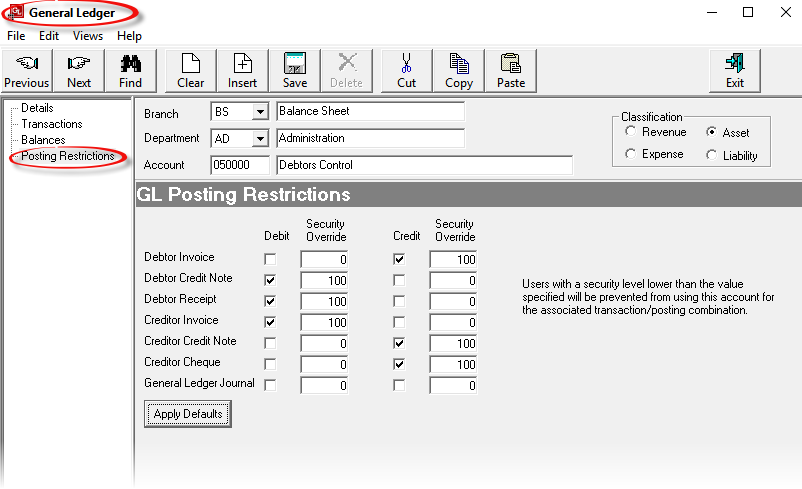

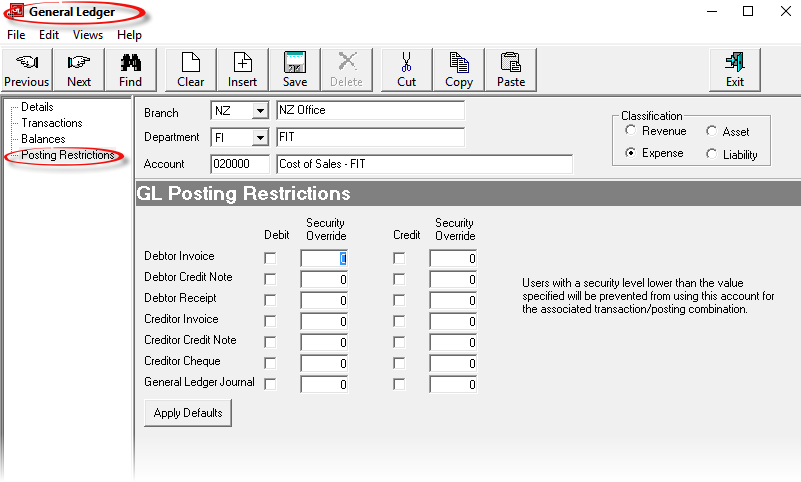

This screen allows restrictions to be placed on G.L. account postings from the subsidiary Debtors and Creditors ledgers on an account by account basis.

These postings can possibly occur when non-booking transactions are being entered in either debtors or creditors and the user is required to select the correct revenue or expense account for the transaction to post to.

Screen Shot 178: G.L. Posting Restrictions Screen

|

The restrictions apply only to the account being worked on. It is not possible to set Posting Restrictions in bulk. |

|

If the debit and credit boxes are unchecked and the Security Override is set at zero then there are no posting restrictions set for this account. |

Restrictions can be applied to either the debit and/or credit postings of the transaction, by transaction type.

To set a restriction, the Debit and/or Credit checkbox must be checked for the transaction type being restricted. The lowest user security level that is authorised to by-pass the restrictions is then entered into the Security Override field(s).

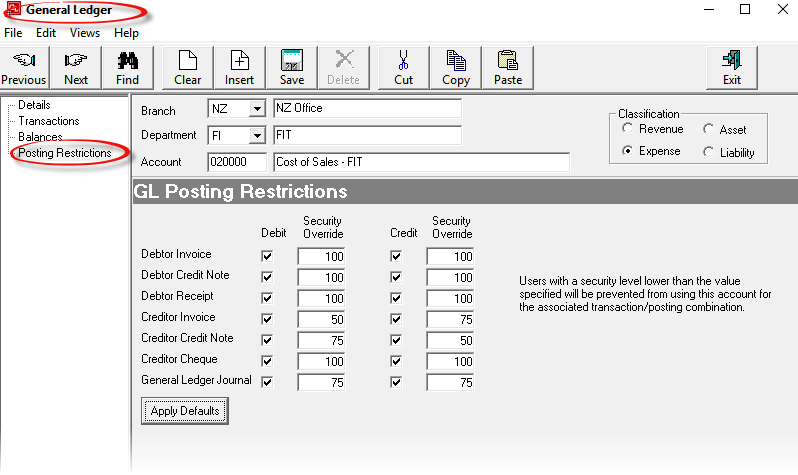

Screen Shot 179: Example G.L. Account Posting Restrictions

Screen Shot 179 Example G.L. Account Posting Restrictions shows how a bookings expense account has been set up to limit the type of transactions and who can create them.

The maximum security level in the Tourplan security system is 99, so in this example, it is impossible for any user to post a Debtors Invoice, Debtors Credit Note or Debtors Receipt to this expense account because the Security Override is set to 100.

Users with a security level of 50 or higher can post the debit side of a Creditors Invoice, but not a credit. This is limited to users with a security level of 75 or higher; the same applies to Creditors Credit Notes. This setting would allow the user with the higher security level to issue negative Creditors Invoices and Credit Notes. The security level of 100 prevents any Creditor’s Cheques from being posted to the account, and only users with a security level of 75 or higher are authorised to post to the account with a G.L. Journal.

A further function is to be able to set automatic posting restrictions against those G.L. accounts which are used by the system for control and reconciliation. These accounts are set in the Tourplan G.L. INI and are:

When one of these accounts is onscreen and the Apply Defaults button is clicked, the system checks that the account number, department and branch match any setting in the G.L. INI and if so, it applies the appropriate default settings. Screen Shot 180 Default Control Account Posting Restrictions shows the default settings for a Debtors Control Account.

Screen Shot 180: Default Control Account Posting Restrictions